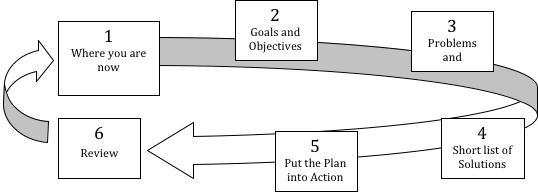

The Six Step Financial Planning Process

Brad Brain CFP, R.F.P, FMA, FCSI is a practitioner of the six step financial planning process.

- The financial planner clarifies the client’s present situation by collecting and assessing all relevant financial data such as lists of assets and liabilities, tax returns, records of securities transactions, insurance policies, will, pension plans, etc.

- The financial planner helps the client identify both financial and personal goals and objectives as well as clarify that person’s financial and personal values and attitudes. These may include providing for children’s education, supporting elderly parents or relieving immediate financial pressures which would help maintain the client’s current lifestyle and provide for retirement.

- The financial planner identifies financial problems that create barriers to achieving financial independence. Problem areas can include too little or too much insurance coverage or a high tax burden . The client’s cash flow may be inadequate, or the current investments may not be winning the battle with changing economic times.

- The financial planner provides written recommendations and alternative solutions. The length of the recommendations will vary with the complexity of the client’s individual situation, but they should always be structured to meet the client’s needs without undue emphasis on purchasing certain investment products.

- A financial plan is only helpful if the recommendations are put into action. Implementing the right strategy will help the client reach the desired goals and objectives. The financial planner should assist the client in either actually executing the recommendations, or in coordinating their execution with other knowledgeable professionals.

- The financial planner provides periodic review and revision of the client’s plan to assure that the goals are achieved. A client’s financial situation should be re-assessed at least once a year to account for changes in that person’s life and current economic conditions.

Are you ready to reach your great goals? Contact us today!