Smart Money December 2018 Newsletter

Taking the Mystery out of the Markets Check out this quick two minute video for insight:

https://vimeo.com/298282584/966ffafdaa

Many of you hold investments with Value Partners Inc. Recently I had the opportunity to speak with Gregg Filmon, CEO of Value Partners. You can check out their approach to investing here:

https://vimeo.com/293374395/be2653333e

Hat tip to Fidelity Investments for the following graphs, links and statistics:

Visual Capitalist: 7 Facts That Will Free You from the Fear of Stock Market Crashes

Key takeaways:

- On average, corrections happen once per year.

- Fewer than 20% of all corrections turn into a bear market.

- Nobody can predict consistently whether the market will rise or fall.

- The market has always risen, despite short-term setbacks.

- Historically, bear markets have happened every three to five years.

- Bear markets become bull markets.

- The greatest danger is being out of the market.

Please click here for the link.

JP Morgan: The Average Investor

Behavioral Finance: Buying high and selling low. It’s why the average investor underperforms.

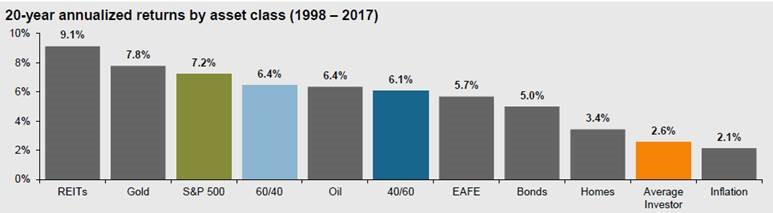

Below is a JP Morgan chart that shows the 20-year annualized returns by asset class: Note that the average investor underperforms the investments that they own.

- The chart above shows that the average investor generates low returns due to their emotions taking over.

- While some investors might have the inclination to leave the market in anticipation of a decline or hold off on investing until the market “settles down,” this market-timing behavior is difficult to get right.

- Study after study shows that when individual investors try to buy low and sell high, they tend to do exactly the opposite. A better strategy is to stay fully invested.

Six strategies for volatile markets

Key takeaways

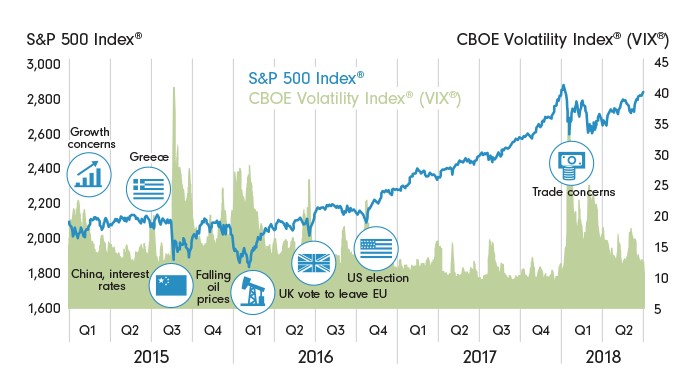

- Uncertainty is a constant, and downturns happen frequently. But market setbacks have typically been followed by recoveries.

- Stay disciplined: Trying to time the market has proven challenging–and could cost you.

- Plan for a variety of markets: An investing approach built with your goals and situation in mind may help you cope with short-term volatility.

- Consider help: Work with your advisor to determine a strategy that fits your risk tolerance.

- Please click here for the link.

Volatility is a normal part of investing

We work best with people who are serious about their finances, have the resources to work towards their financial objectives, and take a long-term view. If you know someone that we should be talking to please don’t keep us a secret!

A reminder:

Please sign up for electronic delivery of statements from Aligned Capital Partners Inc. It will save you $25 a year. If you need information on how to do this, please email mrengel@alignedcapitalpartners.com

If there is anything that we can do to be of service, please let us know.

All the best,

Brad Brain

Disclaimer: This commentary is for general information only and is not intended to provide specific personalized advice. The opinions expressed are those of Brad Brain and not necessarily those of Aligned Capital Partners Inc. (ACPI). ACPI is a member of the Canadian Investor Protection Fund (CIPF.ca) and the Investment Industry Regulatory Organization of Canada (IIROC.ca).

Disclosure:

Brad Brain owns shares in VPGI, the parent company of Value Partners Inc. The amount represents less than 1 percent of the issued and outstanding shares.

Financial advisors that are shareholders in VPGI, the parent company of Value Partners, including Brad Brain, may stand to benefit from the inflow of client money to the Value Partners Pools. Being a shareholder, however, provides advisors like Brad with input to the management of Value Partners. This ownership provides a means of supervision and control over how you are treated and how your money is managed.