Brad Brain offers securities advice to clients in the provinces of BC, Alberta and Saskatchewan.

Securities products are provided by Aligned Capital Partners Inc.

Our investment philosophy:

Our goal is to create long-term wealth for our clients by growing their money at a rate that is appropriate for their financial objectives, while preserving capital and minimizing taxes. We do this by following a well-proven and disciplined investment philosophy of buying excellent businesses in strong, long-term growth industries and holding these investments for the long run.

There are many theories on how to create and preserve wealth. Some of these theories can be quite effective. At least for a while. But when it comes right down to it, there is only one methodology that we have full faith in – Value Investing.

Choose the right heroes!

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insight, or insider information. What’s required is a sound intellectual framework for making decisions, and the ability to keep emotions from corroding that framework.” ~Warren Buffett

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” ~ Warren Buffett

Warren Buffett is one of the richest people in the world. He didn’t acquire his wealth by gambling on some long-shot ideas, or by exploiting some third-world labour force, or by manipulating some tax-loopholes. In fact, he may very well be the most respected, most honest, most ethical capitalist that has ever lived. He’s also made more people millionaires, and billionaires, than anyone else on the planet.

From 1965 to 2022 the Standard and Poor’s 500 Index compounded at an average annual rate of 9.9%. Buffett’s Berkshire Hathaway compounded at an average annual rate of 19.8%, with only one down year. Clearly, outperforming the benchmark by nearly 10% over an extended period of time is impressive, but to truly put the magnitude of this feat into perspective consider this: during this time the total returns of the S&P 500 was 24,708%. Berkshire Hathaway’s total return was an astronomical 3,787,464%.

Buffett’s mentor was a man named Benjamin Graham. Graham developed an investment philosophy designed to shield investors from substantial error and teach them to develop long-term investment strategies. Graham’s book “The Intelligent Investor” outlines these timeless principles, which are just as real and relevant today as when they were first published in 1949. Buffett calls the “Intelligent Investor “by far the best book on investing ever written.”

Value Investing Defined

In simple terms, value investing involves determining the intrinsic value of an enterprise, and then buying the investment at a discount to its true net worth. We are looking for good businesses at good prices, and we are not willing to compromise on either aspect. From this simple definition several principles arise.

1. Own Great Business

If a business is doing well and is managed by people with integrity, intelligence, and energy, it’s inherent value will ultimately be reflected in its share price.

2. Build Concentrated Portfolios

Many investors are over-diversified. This leads to a dilution of the quality of investments, with too much capital tied up in poor investments and not enough in the really good ones. We prefer to find a fewer number of great investment ideas and to take meaningful positions rather than resorting to our second or third best ideas. Approximately 25 businesses are adequate to give diversification to a properly constructed portfolio. Adding more than that does not materially increase the benefits of diversification, but it does increase the detrimental dilution factor.

3. Invest in What You Know

Some investors will make an investment without really understanding why they would want to invest in a business, or even just what it is that they are investing into in the first place. This is a folly. We want to know a business inside and out. It is knowledge that allows us to avoid risk.

4. Ignore the Stock Market

Investment decisions should reflect an opinion of the long-term prospects for a business, not the short-term prospects for the stock market. The stock market is a tool that can be used for our advantage, it is not the arbitrator of our client’s well being. As Buffet says, “As far as I am concerned, the stock market doesn’t exist. It is only there as a reference to see if anyone is offering to do anything foolish.”

5. Employ a Margin of Safety

The key to successful investing is the purchase of shares in good businesses when market prices are at a large discount to underlying business values for any variety of reasons. As Peter Cundhill says, “I am looking to buy a dollar for fifty cents.”

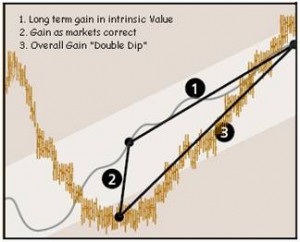

Warren Buffett made reference to this in his 1989 annual report, calling it a “double dip”. This visual reference shows how buying a stock below its intrinsic value can have two benefits. (1) the long term gains in intrinsic value that the companies have achieved; (2) the additional gains as the market corrected the prices of these companies, raising their valuations in relation to those of the average business.

6. Be Patient

Many of history’s great investors have suggested that the key to their success lay not in what they did, but rather in what they did not do. They did not yield to their emotions or to the pressure to follow the crowd. Instead, they focused on the business they owned and watched as their value compounded over time.

Implementation

There are different ways that we can implement these ideas. We are always on the lookout for good ideas ourselves. We also team up with other like minded business partners, such as Value Partners, Edgepoint, Dixon Mitchell, Antares and Leon Frazer.

Brad Brain interviews Gregg Filmon, CEO of Value Partners

| 0:00 | Introduction. Tell us about VPI. |

| 4:29 | How is Canadian Equity pool doing? |

| 8:05 | What makes a good investment? |

| 15:20 | Why is it important to have an employee owned firm? |

| 20:45 | What is the benefit of accountability & transparency that VPI provides? |

Investments, TFSAs, RRSPs, RESPs & RDSPs

- Mutual Funds

- Stocks and Bonds

- Flow through Limited Partnerships

- High interest Savings Accounts (through referral)

- GIC’s

- Exchange Traded Funds

Education, Tax and Estate Planning

- We utilize Registered Education Savings Plans and in trust accounts for your children and grandchildren

- We offer tax planning to help you keep more of what you make

- We offer estate planning to ensure that your estate is distributed in the way that you want with the least amount of expense and delay

Disclosures

Aligned Capital Partners Inc. is a member of the Canadian Investor Protection Fund (www.CIPF.ca) and the Investment Industry Regulatory Organization of Canada (www.IIROC.ca). This website is for general information only and is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting, or tax advice. Please consult an appropriate professional regarding your particular circumstances.

This website does not constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation. Brad Brain is an agent of Aligned Capital Partners Inc. (ACPI). Brad is also licensed for the sale of life insurance and financial planning products/services. Brad is registered through separate organizations for each purpose and as such, you may be dealing with more than one entity depending on the products purchased. Brad will provide the name of the entity being represented when insurance/financial planning business is conducted.

All non-securities related business conducted by Brad Brain is not in the capacity of agent of ACPI and is not covered by the Canadian Investor Protection Fund (CIPF). Non-securities related business includes, without limitation, advising in or selling any type of insurance product, advising in or selling any type of mortgage service, estate and tax planning or tax return preparation. Accordingly, ACPI is not liable and/or responsible for any non-securities related business conducted by Brad Brain and Brad Brain Financial Planning Inc.. Such non-securities related business is the responsibility of Brad Brain alone. Reference in this website to third party goods or services should not be regarded as an endorsement of these goods or services.

The information contained on this website is for general information purposes only and is the opinion of the owner and writer. This information is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, account, or tax advice. However, please call Brad Brain to discuss your particular circumstances.

The information contained on this website is subject to change without notice.

|

|

|

ACPI Privacy Notice |

ACPI Complaint Resolution Policy |

Know Your Advisor |